|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

an7yxgydj5 Best CRM for Wealth Management: Choosing the Right Solution for Your BusinessIn the fast-paced world of wealth management, having the right Customer Relationship Management (CRM) system can make all the difference. With numerous options available, selecting the best CRM can be challenging. This article will explore the key features to consider and highlight some of the top CRM solutions in the industry. Why Wealth Management Firms Need a CRMWealth management firms handle complex client relationships and need efficient systems to manage these interactions. A robust CRM helps streamline processes, improve client service, and enhance data management. Key Features of a Wealth Management CRM

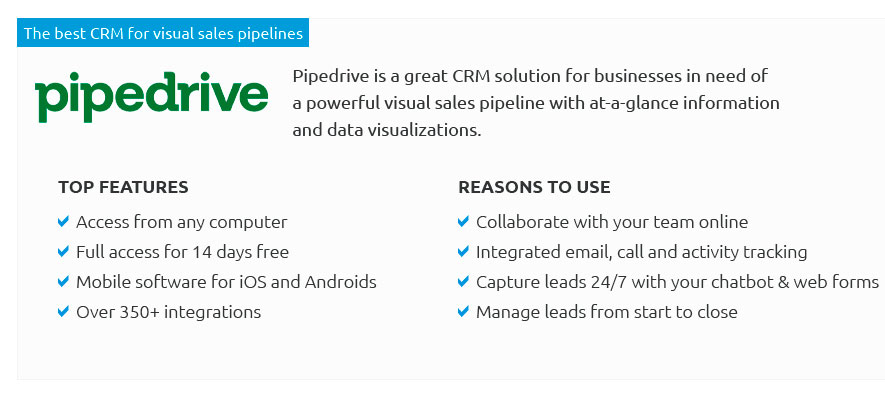

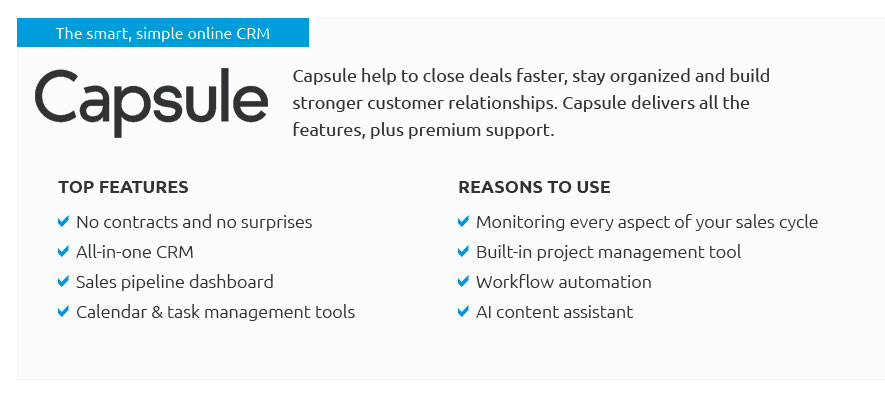

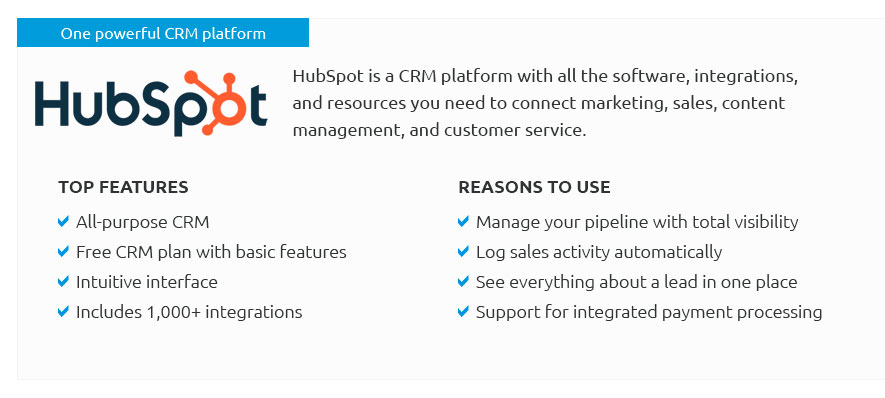

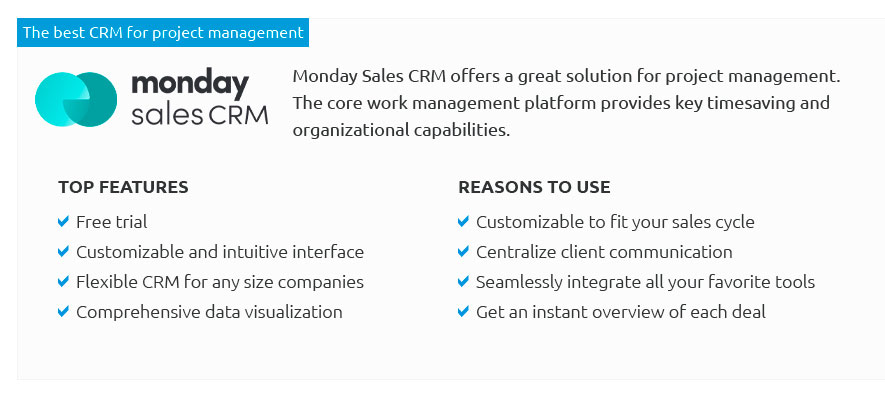

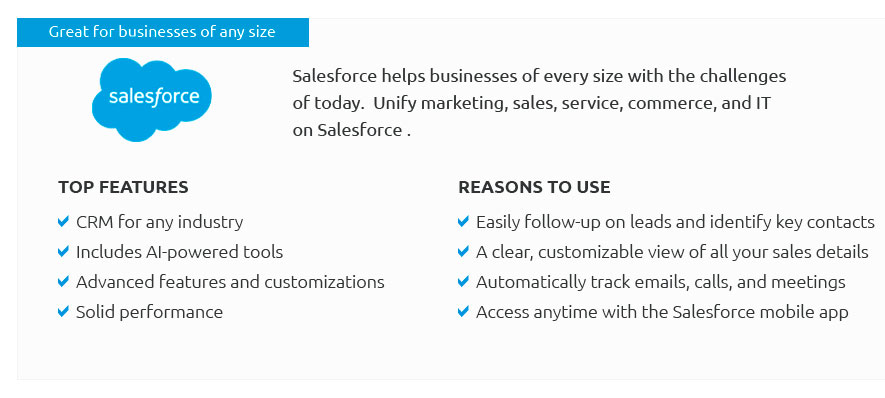

Top CRM Solutions for Wealth ManagementWith numerous CRM SaaS companies offering solutions, it's essential to choose one that fits your firm's specific needs. Popular CRM Options

By using tools to track project progress, wealth management firms can ensure their CRM implementation aligns with business goals. How to Choose the Right CRM for Your FirmChoosing the right CRM involves evaluating your firm's specific needs, budget, and existing technology infrastructure. It's crucial to involve key stakeholders in the decision-making process to ensure the solution meets everyone's requirements. Frequently Asked QuestionsWhat is a CRM in wealth management?A CRM in wealth management is a system used to manage client relationships, streamline operations, and enhance data management for financial advisors and wealth management firms. How does a CRM improve client relationships?A CRM improves client relationships by providing a centralized database of client information, enabling personalized communication, and automating routine tasks, allowing advisors to focus on building stronger client connections. What should I consider when choosing a CRM for my firm?When choosing a CRM, consider factors such as ease of use, integration capabilities, scalability, cost, and the specific features that align with your firm's needs. https://smartasset.com/advisor-resources/choose-the-right-crm-for-your-advisory-practice

Redtail is the best CRM for financial advisors who want a software program that's easy to navigate. The interface is designed to be user- ... https://www.reddit.com/r/CRM/comments/1cnzjl1/advice_on_crm_for_financial_advice/

EspoCRM is a great open-source option that can be adapted to meet the needs of financial advisors. It offers robust client management features, ... https://www.salesforce.com/financial-services/wealth-management-software/advisors/

Financial Services Cloud offers the best CRM software for financial advisors. It is cloud-based, which means that users can take advantage of what it has to ...

|